straight life policy term

Straight Whole Life Insuranceor ordinary life. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

Life Insurance Converage Life Insurance Quotes Life And Health Insurance Life Insurance Marketing Ideas

Example of a Decreasing Term Policy.

. However 20-year limited pay life policies are. Straight life insurance is a type of whole life insurance. Straight life insurance is more commonly known.

Like other forms of whole life insurance the death benefit of a straight life policy is. What Does Whole Life Insurance Mean. Looking for information on Straight Life Policy.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. A father who dies within 3 years after purchasing a. For example a 30-year-old male who is a non-smoker might pay a premium of 25 per month throughout the life of a 15-year 200000.

A life insurance policy that provides coverage only for a certain period of time. An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. To save money you decide to purchase a much shorter term life insurance.

10-year Renewable and Convertible Term B. An insured has a variable life policy with a 100000 face amount. A straight term insurance policy provides a benefit upon the death of the.

Term life insurance covers you for a specific number of years usually 10 20 or 30 years while whole life insurance covers you for life as long as you keep up with your premiums. Earnings per share EPS Beta. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Life Paid-Up at Age 70 C. Term Ticket Model In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term. Which of these would be considered a Limited-Pay Life policy.

Straight term insurance policy. Rates for a 10-year term will be less compared to rates for 30 years or the 20-year term life insurance policy. At one time the cash value exceeded 100000 and was worth 150000.

A straight life policy has what type of. Term life insurance policy providing a fixed-amount death benefit over a certain number of years. Life Paid-Up at Age 70.

Which statement is NOT true regarding a Straight Life policy. Straight Term Insurance Policy. Continuously premium straight life policies are designed so that the premiums for coverage will be completely paid for by the insureds age of 100.

What is a Straight Life Policy. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings. Also known as whole or ordinary life insurance the policy has.

After death however the payments cease and the. The face value of the policy is paid to the insured at age 100 B. It usually develops cash value by the end of the third policy.

Renewable Term to Age. Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy. Term life policy While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage.

Straight Whole Life D. Straight life policy vs. 10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100.

Click to go to the 1. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere.

10 Best Tips If You Re Buying Life Insurance For The First Time Forbes Advisor

Life Insurance Over 70 How To Find The Right Coverage Life Insurance Quotes Term Life Insurance Quotes Term Life

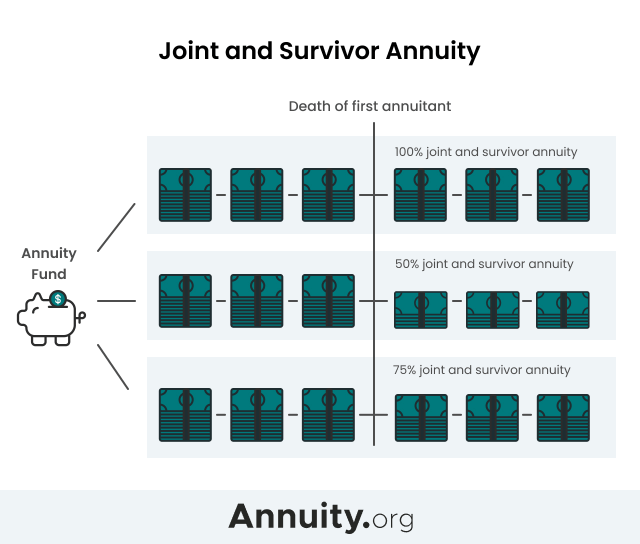

Joint And Survivor Annuity The Benefits And Disadvantages

Why Buying Health Insurance Is Important Health Insurance Infographic Buy Health Insurance Life Insurance Marketing Ideas

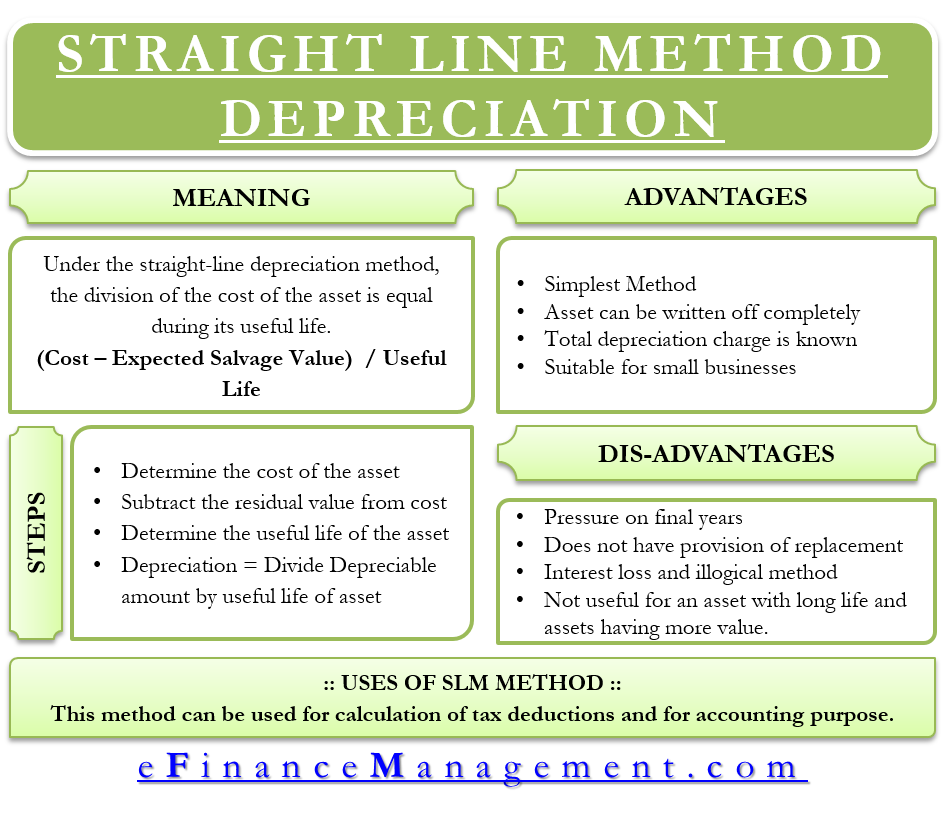

Straight Line Depreciation Formula Guide To Calculate Depreciation

/LinearRelationshipDefinition2-a62b18ef1633418da1127aa7608b87a2.png)

Linear Relationship Definition

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Efinancemanagement

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks

Choose From Range Of Life Insurance Plans And Term Insurance Plans Along With Other Policies Life Insurance Quotes Best Health Insurance Health Insurance Quote

Annuity Payout Options Immediate Vs Deferred Annuities

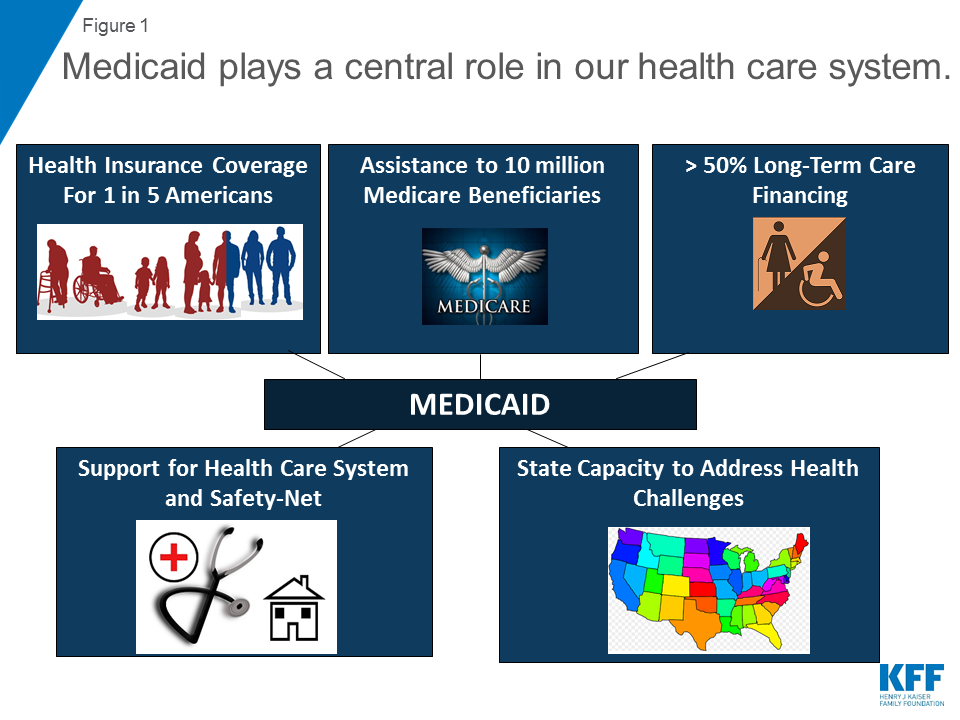

10 Things To Know About Medicaid Setting The Facts Straight Kff

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)